Hi, My Name is Mariam

With over 5 years of mortgage lending experience, I provide expert guidance from pre-approval to closing making your home financing journey smooth, transparent, and stress-free.

Finding the right mortgage shouldn’t be stressful, it should be empowering. With a deep understanding of the lending process and a passion for helping clients succeed, I’m here to make your home financing journey simple, transparent, and tailored to your goals.

Whether you’re purchasing your first home, refinancing for better rates, or exploring new loan options, I provide clear guidance, honest advice, and a smooth experience from start to finish. My focus is always on what matters most your long-term success and peace of mind.

I don’t just close loans I build lasting relationships based on trust, communication, and results you can count on.

Mariam Abdelmalik

Senior Loan Officer

NMLS# 1982723

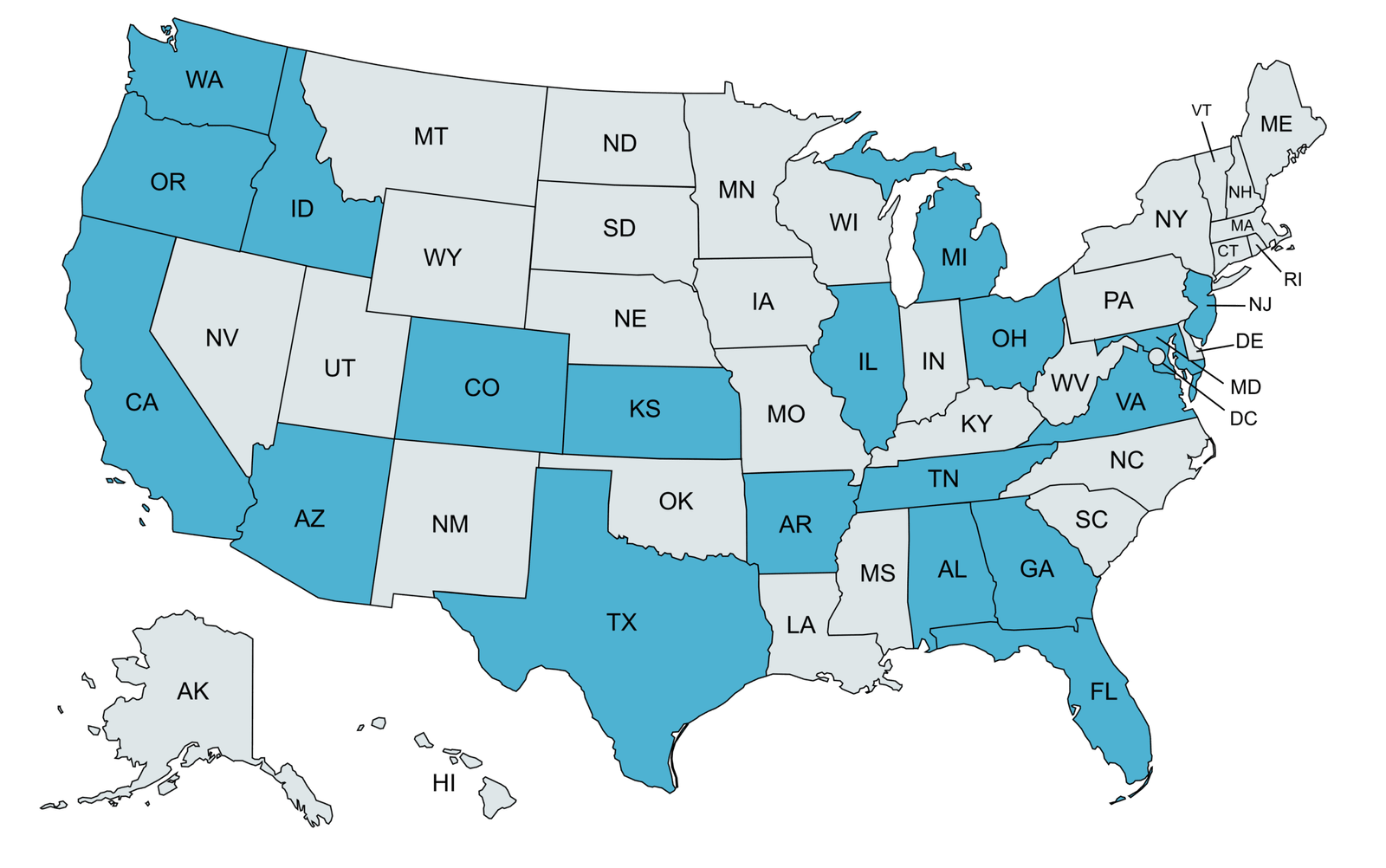

Licensed in CA, AL, AZ, KS, MI, OR, OH and VA

Actually, it’s not About Us. IT’S ABOUT YOU…

pursing your dream of homeowning or investing for your future. Our goal is to fully support you in that pursuit, starting with your financial wellbeing. By providing and recommending mortgage solutions based on your needs, offering guidance based on your desires, and being flexible on our approach based on your priorities!

Every borrower’s story is unique, and so is every loan. I focus on providing clear communication, personalized solutions, and expert support to make financing your home as simple and successful as possible.

I take the time to understand your goals and match you with the best loan options available for lasting success.

From application to approval, you’ll always know where things stand with clear updates and support.

Licensed across several states, I help clients secure loans with ease wherever they call home.

Take the first step toward homeownership with a fast and reliable pre-approval. Know your true budget, strengthen your offers, and move through the buying process with clarity all with expert guidance every step of the way.

Mariam offers practical tips and personalized insights to help you improve your credit score before applying for a mortgage. From understanding what affects your score to adopting smart financial habits, she’ll guide you every step of the way toward stronger credit and better loan opportunities.

Take control of your financial future with practical steps to boost your score and prepare for homeownership success.

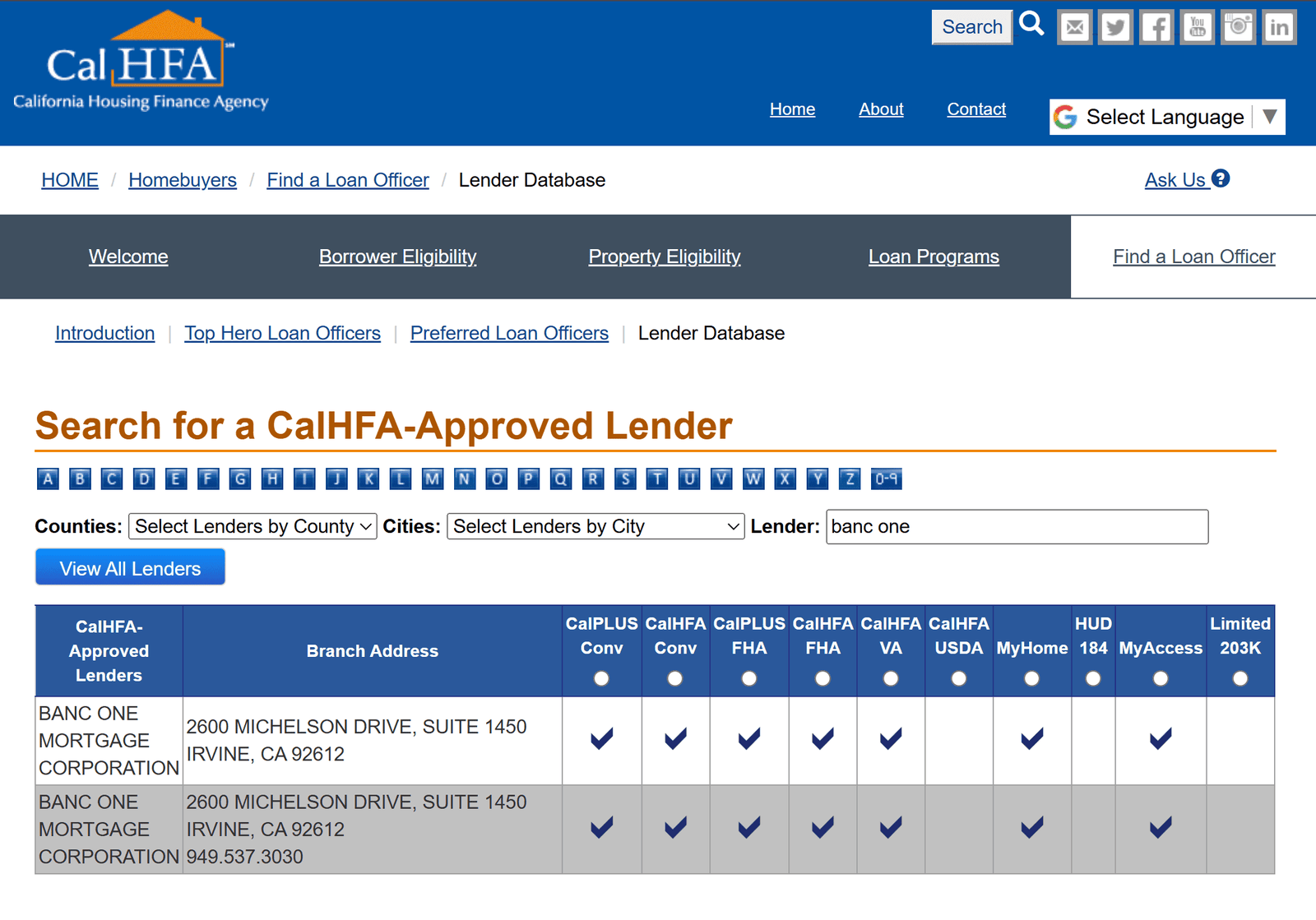

Banc One Mortgage is honored to be an approved lender with CalHFA and the Dream For All (DFA) program helping California residents achieve homeownership through innovative down-payment assistance and affordable loan solutions.

Mariam and her team can guide you through every step of the DFA process to make your dream home a reality.

Officially authorized to offer CalHFA-backed loan programs.

Guidance through every detail of California’s DFA homeownership program.

Banc One Mortgage is among only 12 lenders qualified for DFA loans.

You’ll typically need recent pay stubs, W-2s, tax returns, and bank statements. These help verify your income, assets, and credit to determine your eligibility.

Down payments vary by loan type. Conventional loans can start as low as 3%, while FHA and VA loans offer low or no down payment options depending on eligibility.

Most loans close within 30 to 45 days, depending on how quickly documents are submitted and the loan type. I’ll help keep things on track from start to finish.

Many loan programs accept credit scores as low as 580–620. I’ll review your full financial picture to find the best options available to you.

Absolutely! Getting pre-approved gives you a clear budget and makes your offers stronger when you’re ready to buy.

Yes! I’m licensed in Alabama, Arizona, Kansas, Michigan, Ohio, Virginia, California, and Oregon, and can guide clients remotely through the entire process.

Don't have an account? Sign Up